Last updated on

On 23.07.2021, 12 bad loans have been repurchased to investors at a price of 20% of their outstanding.

It represents an outstanding of 130 462 BGN for a total price of 26 092 BGN.

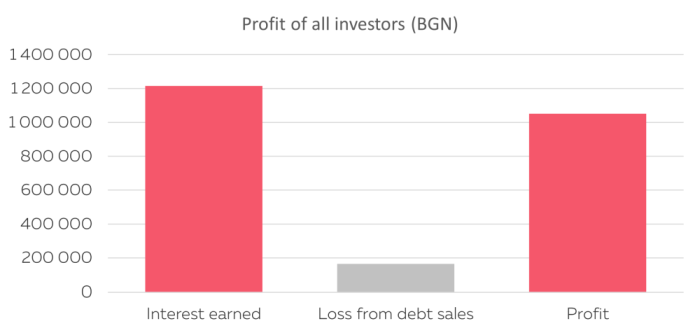

After this event, the overall profit of the investments in the platform since the beginning stands at 1 052 961 BGN, resulting from a total earned interest of 1 216 237 BGN deducted by 163 275 BGN total loss on bad loans.

The average yearly return is 6.5 %.

Announcing losses may not sound like good news but indeed it’s another perfect opportunity to demonstrate that our P2P lending model works well. Very well indeed!

As you can see, over 5 years since the beginning of the platform, the losses on bad loans represent a small fraction of the total interest earned.

Why 80% discount?

All these loans had a serious delay, more than 5 installments late, and their KIP value (reminder: KIP is an indicative discount provided on each loan for sale on the secondary market) was 80% or even more.

Therefore, we decided to use KIP to calculate the price (Price = 100% - KIP), with a minimum price of 20%.

How did you select these loans?

We took all loans with 5 or more installments in delay, and which did not pay at least 200 BGN in the last 3 months.

That’s why you may still see some loans with the highest level of delay in your portfolio, because although in delay for a long time, they are still active with payment from time to time and there is still a chance for them to be fully repaid.

Who purchased?

Klear purchased these loans as unfortunately we did not find a collection agency willing to make a debt purchase.

Why did you wait so long?

The last 18 months we lived in have been quite hectic. It was out of question to try to sell bad loans for some time after the breakout of the Covid pandemic. Besides, with regulatory changes in the litigation process (10 years forgiveness), many debt collection agencies had limited or even frozen their purchases.

We also waited to accumulate several loans (above 10) to get interest from potential purchasers. Unfortunately, we did not find one and we eventually took the decision to repurchase them to clean the portfolios.

What’s going to happen in the future?

We’ll try to change our approach and to negotiate a regular deal with an agency where we commit to sell automatically every loan when it reaches a certain level of delay, at a pre-agreed price.

We will therefore adjust the KIP model to be consistent with the conditions we may get.

What if I want to get rid of my bad loans before you find a regular solution?

You can always list for sale your loans. The higher the discount, the faster you’ll get rid of them.

We remind you that KIP is giving a sensible indication of the discount you could offer.

What is the impact on my return?

If you owned some of these loans, their outstanding have disappeared from your portfolio (you can still find them in your portfolio by using the filter “State: defaulted”) and you received in your wallet a transaction for each of them equal to 20% of the amount you were owning.

This loss of 80% has decreased your profit, but if you have a well-diversified portfolio and did not actively trade on the secondary market, it should represent a small amount compared to the total interest you earned so far.

Overview of the Loan portfolio – November 2020

Overview of the Loan portfolio – November 2020

How did P2P lending fare during COVID-19?

How did P2P lending fare during COVID-19?

Overview of the Loan portfolio – October 2019

Overview of the Loan portfolio – October 2019

Results after 2 years of investing with Klear

Results after 2 years of investing with Klear