Last updated on

This pandemic has impacted the world in an unprecedented way.

It is far from being finished, but more than 3 months have passed since the declaration of the emergency state and we thought it useful to dig into various indicators to assess its impact on Klear P2P lending activity.

The first part covers the credit activity, the second one the investment behaviour.

At the end, we’ll make a conclusion although we all know that forecasts are a difficult exercise in this period. 😉

A. Lending activity

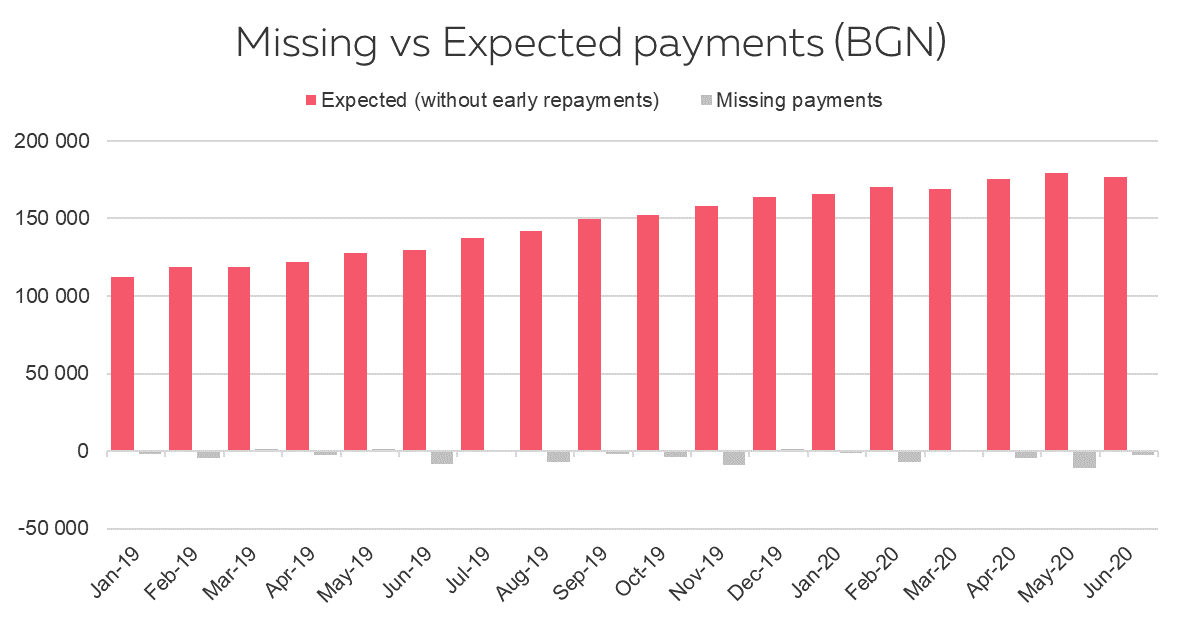

1. Missing payments vs expected payments

“Expected payments” is the amount due to be paid during the month by all borrowers. “Missing payments” is what we did not receive or was not postponed at the end of the loan after a partial payment of the borrower (see chapter 4.).

The share of missing payments remained rather stable during the period, at a low level.

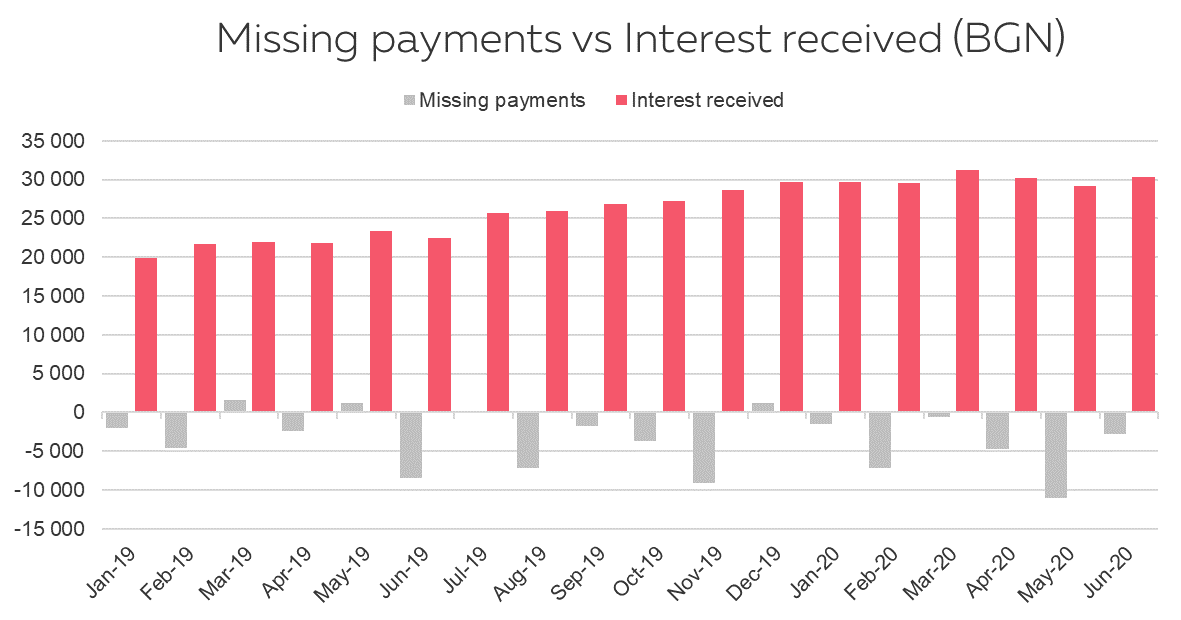

2. Missing payments vs interest received

“Interest received” is the part of the interest among all the payments made by the borrowers during the month.

During the last 3 months, the interest received covered way more than the missing payments, which verifies the key assumption of the P2P lending model.

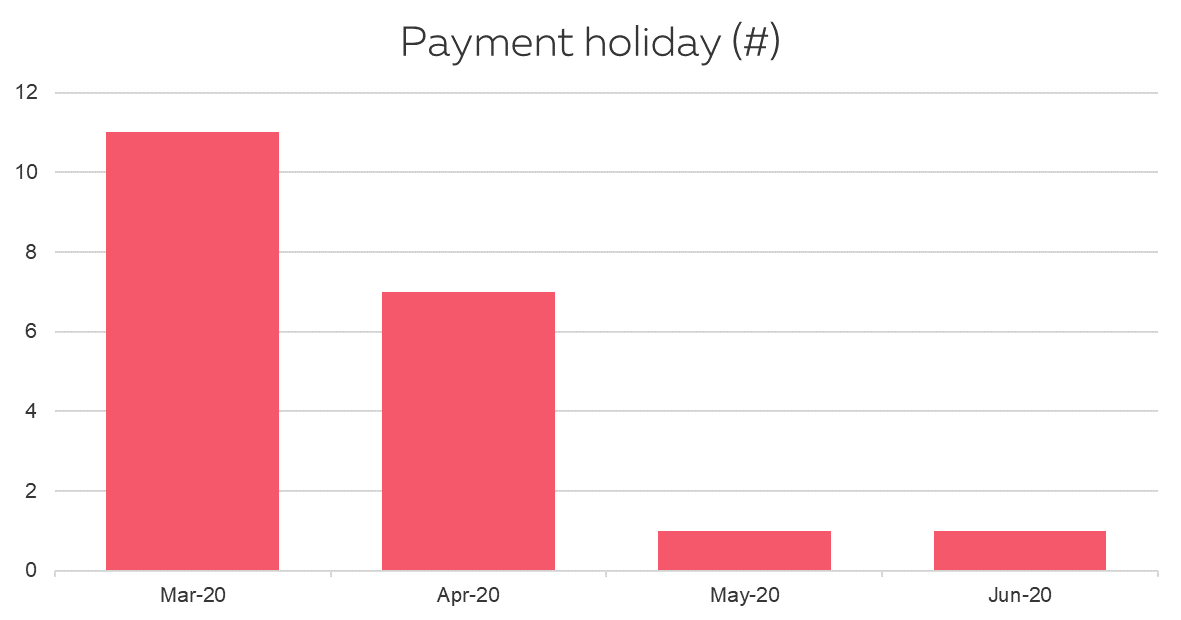

3. Payment holiday

We had invited borrowers who anticipate difficulties to contact us in advance. A 1-month payment holiday has been agreed on a few difficult situations. A 1-month payment holiday means that the whole amount of the installment which was supposed to be paid during this month is postponed at the end of the credit.

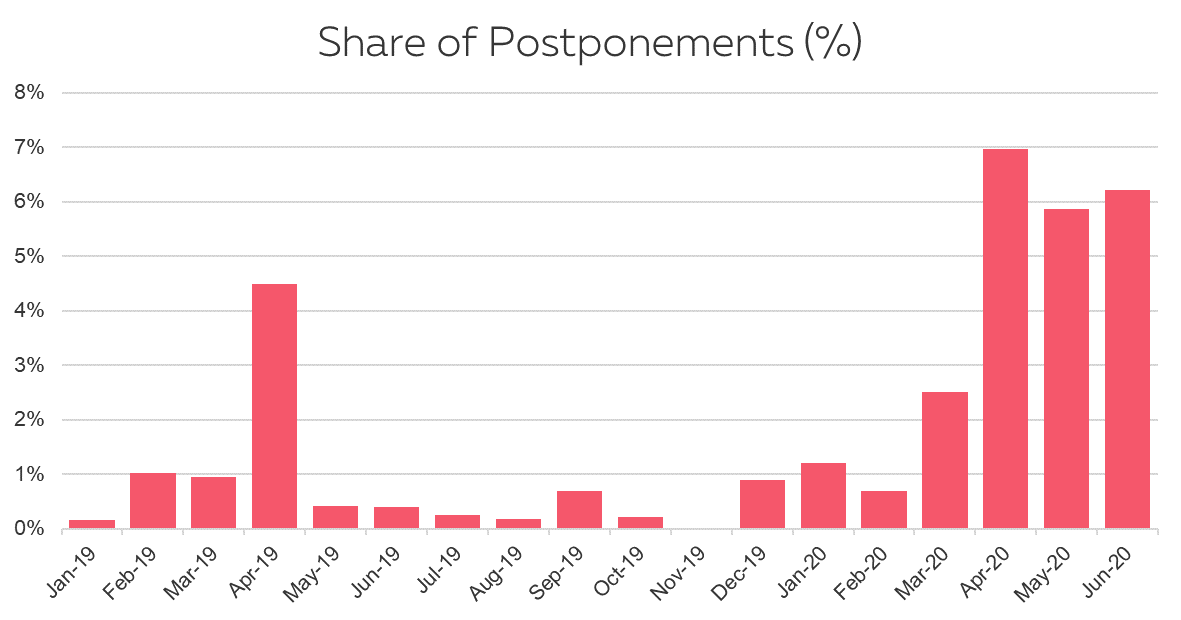

4. Postponements

Postponement of the remaining overdue is done in agreement with the borrower after a partial payment of the delay and a promise to start over regular payments.

During the last period, the rate of postponement logically increased to help borrowers with a temporary decrease in revenues. The level remains however at a low absolute value.

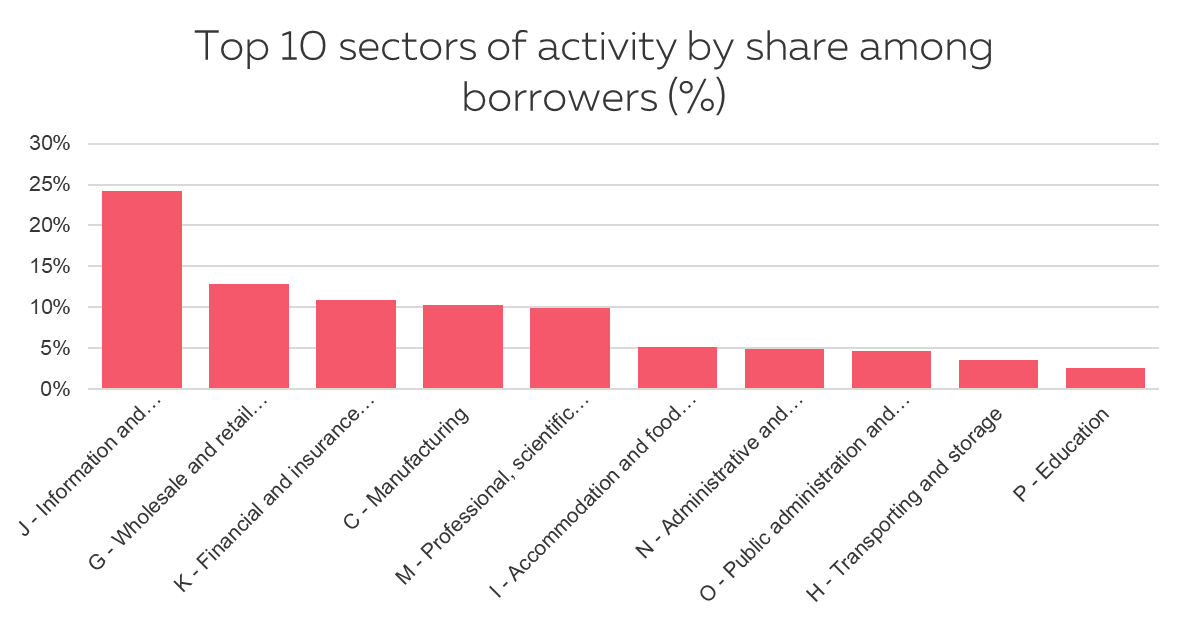

5. Sector of activity of the borrowers

Here we show the top 10 sectors of activity in which our borrowers work, classified according to the NACE codification.

By far, the main sector of activity is “Information and communication” which is mainly constituted of IT companies.

Then comes the wholesale and retail trade sector, which includes mainly distributors and shops.

The third is the financial sector. Seems many of the employees of our competitors like our services. 😉

The fourth is manufacturing and the fifth is professional services, with a big share of outsourced services like call-centers.

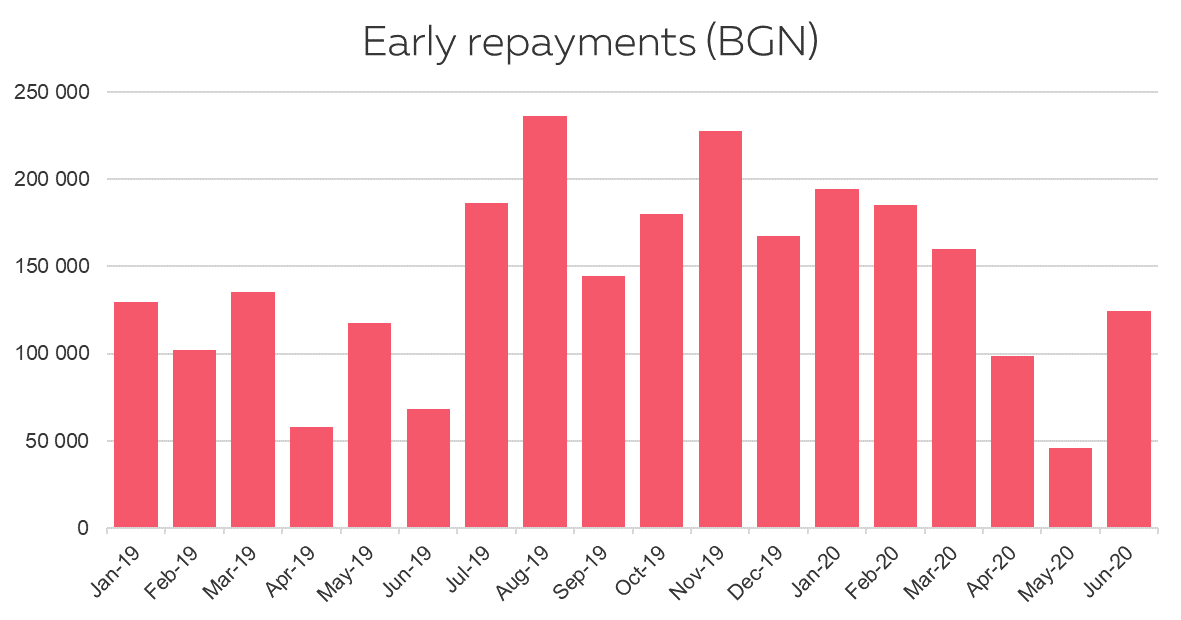

6. Early repayments

This is the amount of full early repayment (anticipated termination) or partial early repayment.

The volume of early repayments dropped significantly, although rebounding in June. On one hand, probably less exceptional revenues were received, or people preferred to keep this extra money received as a reserve for the uncertain future. The other probable reason is that fewer borrowers consolidated their existing loan with a new one.

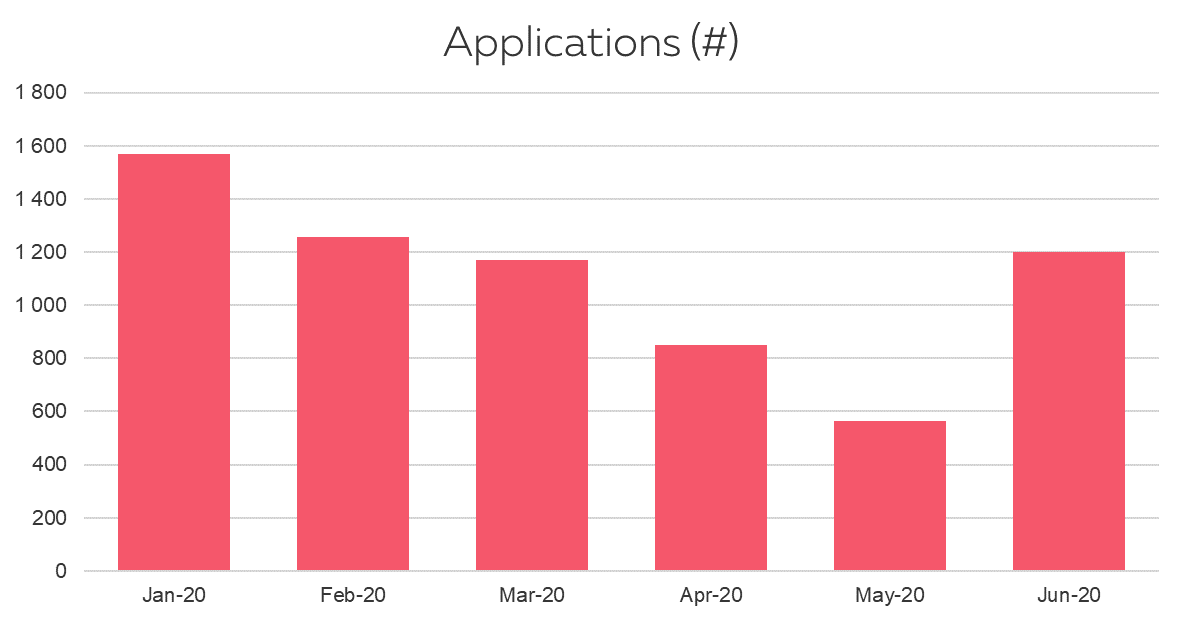

7. Credit applications

We count here all the applications where enough data was provided by the user to calculate the score and check the credit history. Please note that not all these applications were completed with a signed contract: some were automatically rejected by the system; some were not completed because the user did not finish the process.

We observed a drop in the number of loan applications, with a low in May. Demand obviously plummeted but we also stopped any communication action during this period which also contributed to lower the number of applications.

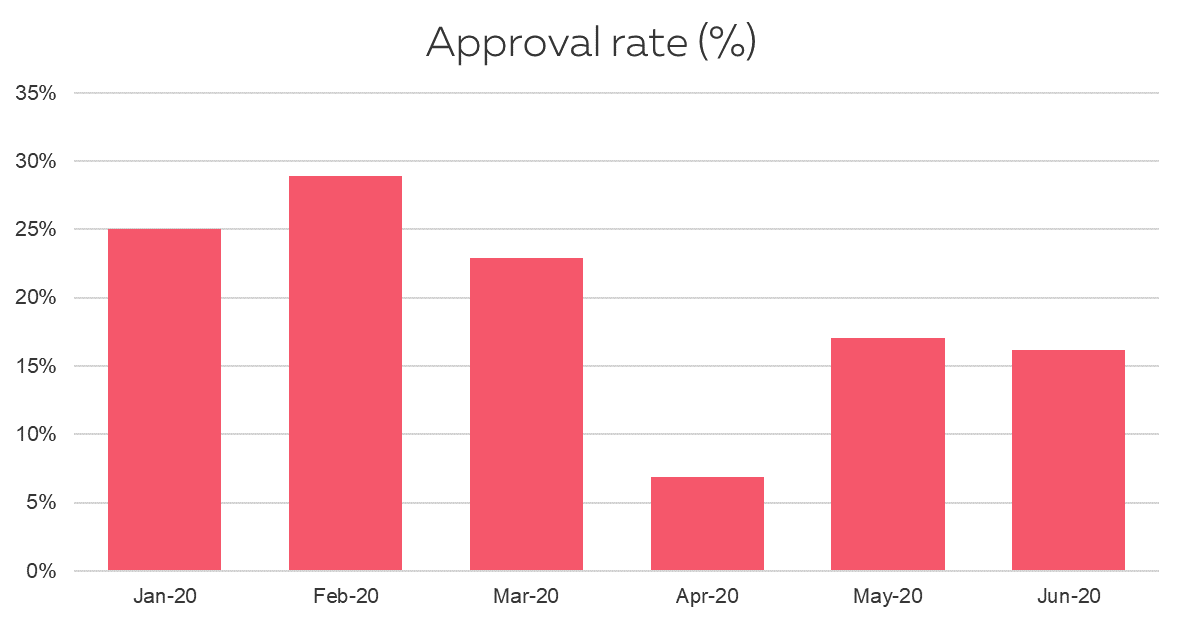

8. Approval rate

This rate is calculated on the completed applications, i.e. excluding all applications automatically rejected by the system.

The rejection rate increased. We did not change the granting rules but the demand for credit from good profiles dropped.

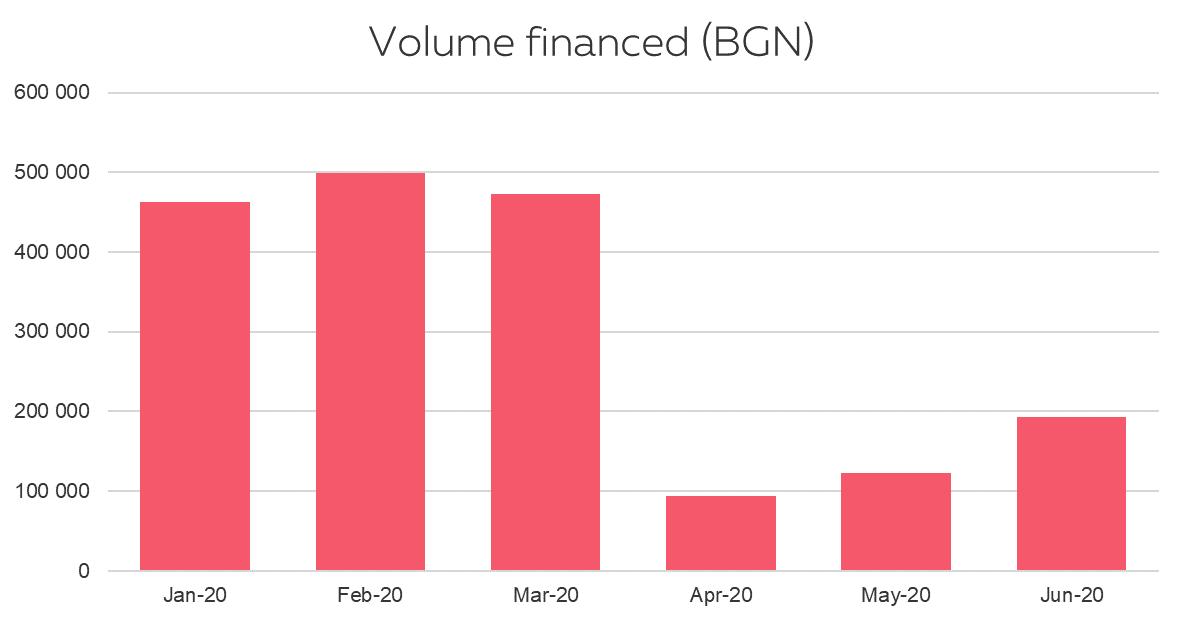

9. Financed volumes

There was a big drop. Naturally, many people preferred to postpone their project not to take the risk to have difficulties of repayment. Besides, the average amount also decreased which is an additional factor.

However, June shows a positive trend.

B. Investing activity

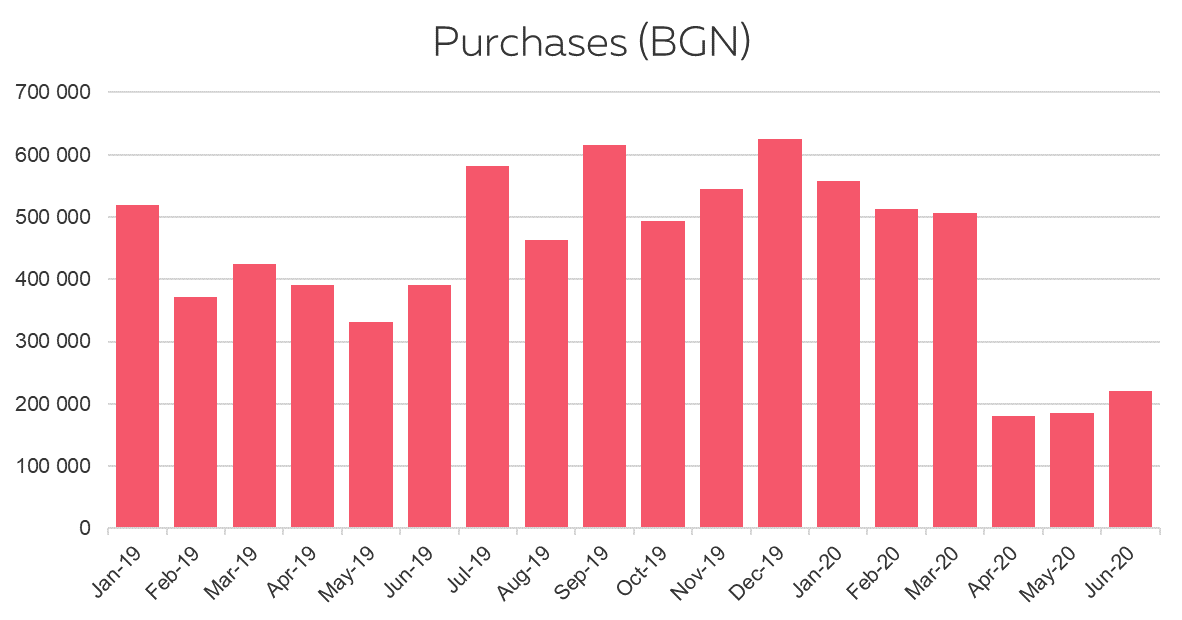

1. Purchase of loans

It is the amount purchased each month by our investors with the money from their wallet.

We can notice a sharp drop in the amount invested in April, with a slight increase since but still far from the average activity before COVID.

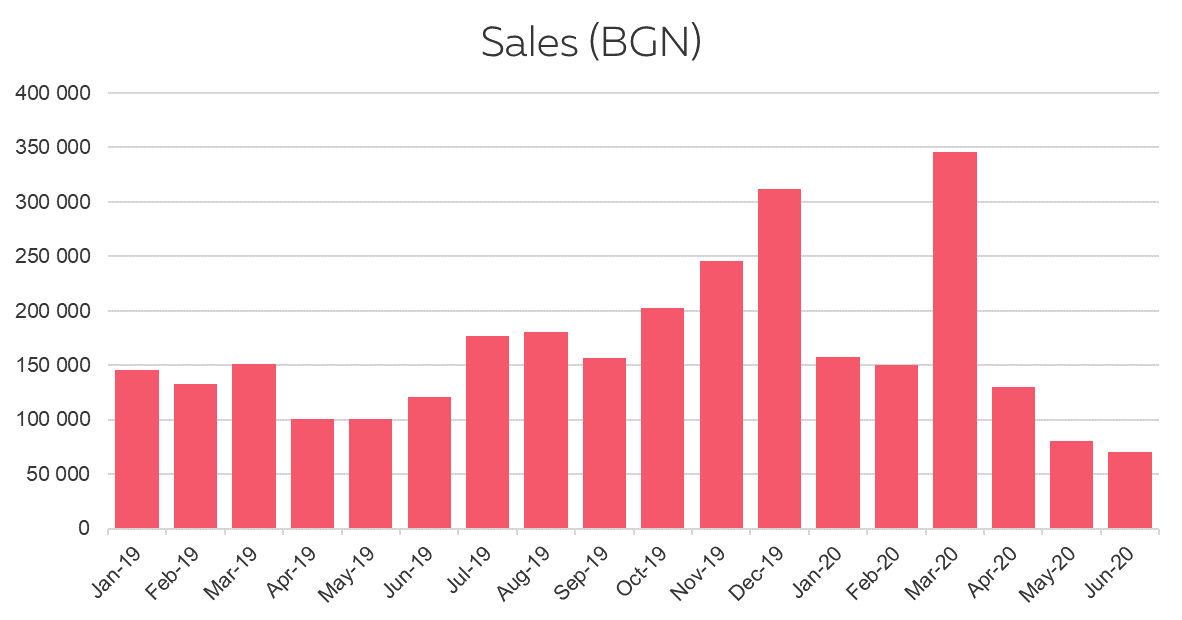

2. Loans sold by investors

It is the outstanding sold by our investors in both markets.

There was a surge of sales in March, at the time the emergency state was declared.

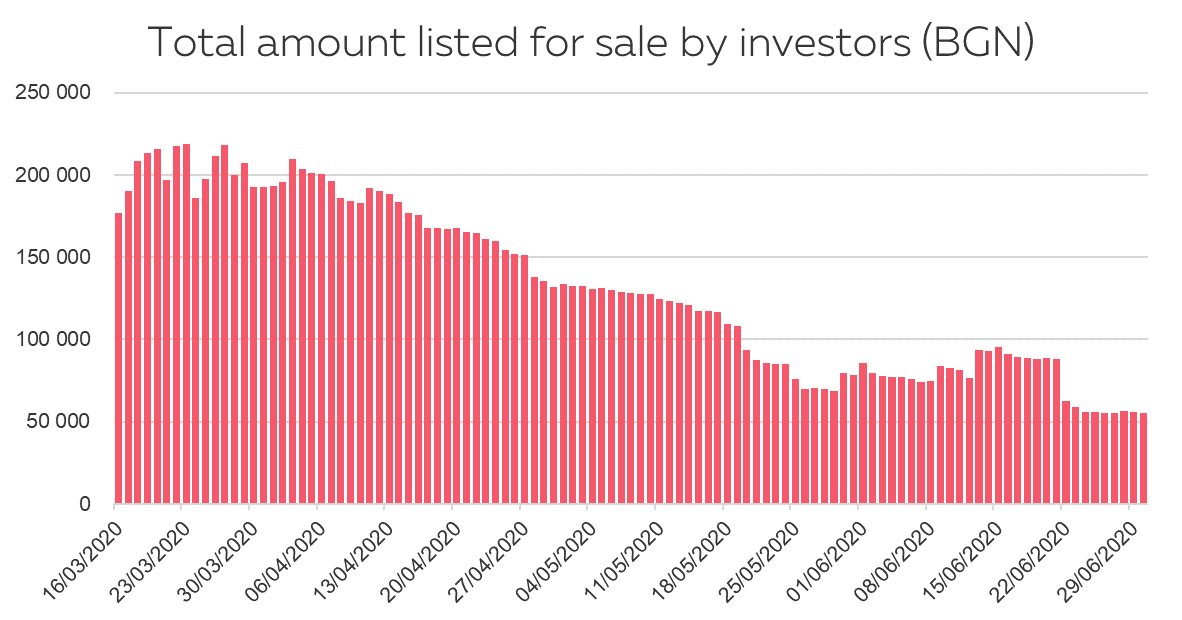

3. Stock listed for sale by investors

As we noticed a surge of loans listed for sale on both markets, we started following closely the total amount of loans listed for sale by our investors daily.

The surge peaked at the end of March and then progressively decreased as investors were able to sell, although at a slower pace than before. The amount listed now is back to the levels pre-COVID.

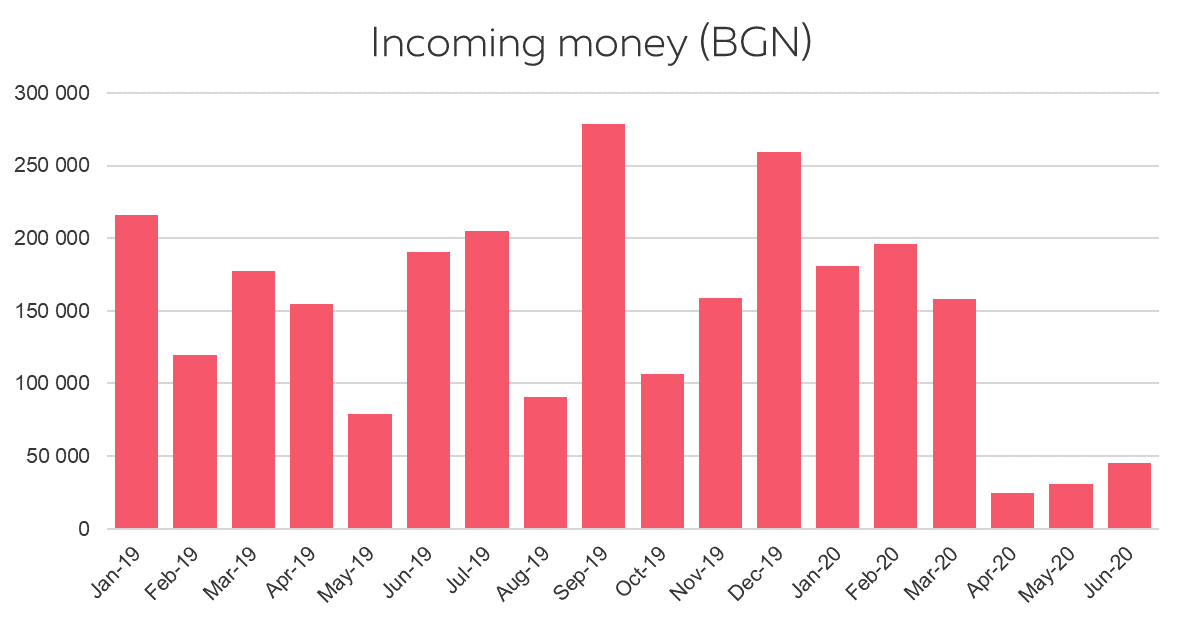

4. New inflow of money

This is the incoming money sent by our investors to their Klear wallet.

As many investors adopted a “wait and see” attitude, the inflow of fresh money decreased drastically in April. Since then, it is on an increasing trend although still not back at the levels pre-COVID.

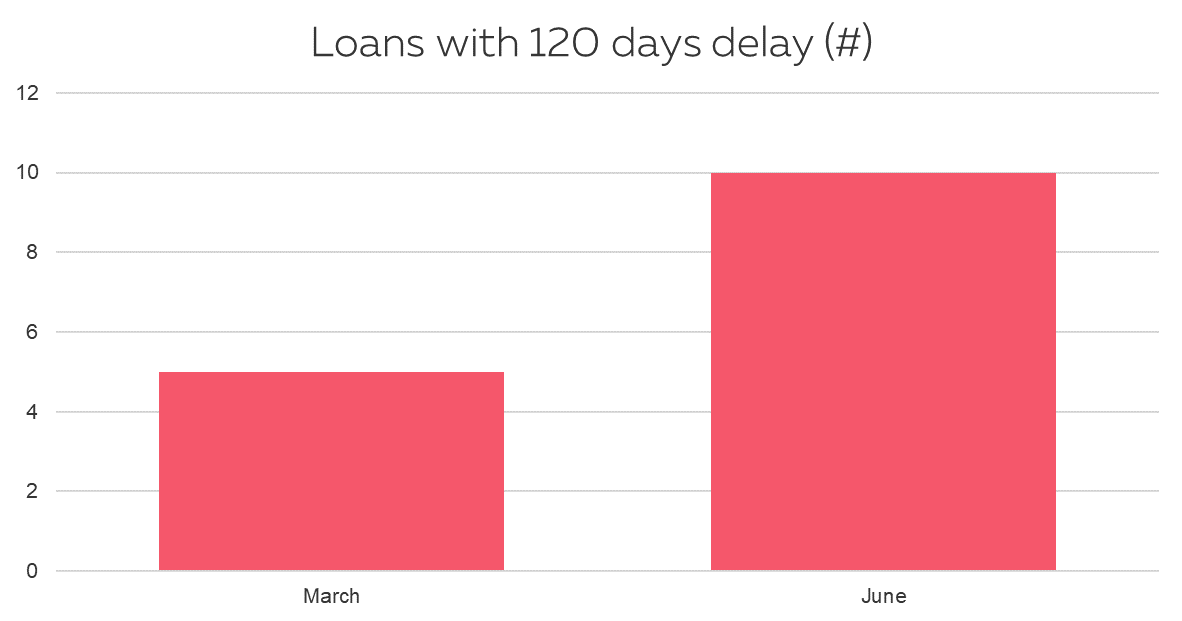

5. Loans with more 120 days delay

The number of loans with more than 120 days has increased by 5. We will probably not sell these loans very soon as the market for bad loans is not suitable.

Besides, we have a number of them with recent payments or with a reasonable promise of payment in the near future.

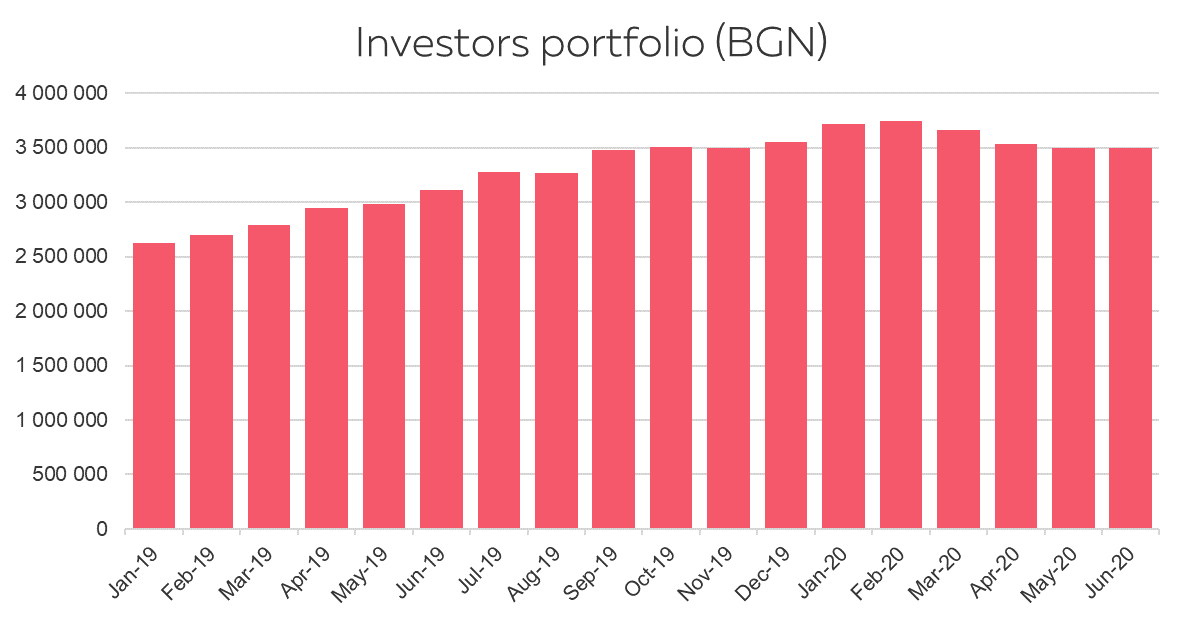

6. Portfolio

It is the outstanding owned by our investors.

Unsurprisingly, the regular growth was halted in March. The positive way to look at it is to mention that from the portfolio at the end of February, 9% has left Klear (or is for listed for sale) and 91% stayed.

C. Conclusion

Although this period has seen serious troubles, we have a very positive insight into our Peer-to-Peer lending model.

First, the portfolio of loans behaved well so far. Yes, the invitation to our borrowers to contact us and request a partial postponement has helped. But the usage remained very limited and no one abused of that. We appreciate very much the effort of our borrowers to remain on track.

On the other hand, the very positive news is that, after some initial concern, most of our investors stayed, supporting our fair action to help borrowers in temporary trouble. We now see that new investments have started again to come. This is great to have your customers standing with you. Thanks!

Finally, the volume of new loans has dropped very significantly, and it will take some time to be back to previous levels as people are more cautious in making plans for the future.

However, we are confident that in the long run, more and more people will believe in the P2P lending model and use fair online financial products. 😊

Klear 5 years and 20 milestones

Klear 5 years and 20 milestones

Overview of the Loan portfolio – October 2019

Overview of the Loan portfolio – October 2019

Is P2P lending providing better conditions than banks?

Is P2P lending providing better conditions than banks?

4 most frequently asked questions by our investors

4 most frequently asked questions by our investors