When Zopa, the first P2P lending platform, launched in the UK in 2005, it was with the promise to offer lower interest rates on credits and higher returns than deposits.

Well, let’s look how it worked out!

The sharing economy principle

P2P lending is simply the application to Finance of the beautiful principle of the sharing economy, already wildly present in car or apartment sharing.

People – investors - who have an asset – money - will share it with others – borrowers - who need a credit. For this, they will get a reward, the interest.

The role of a P2P lending platform is to find users from both sides of the equation, to assess and filter credit applicants, to connect them with investors and to manage the repayment of the loans to the investors who contributed to a share of each loan.

Simple and brilliant idea!

Better conditions, really?

The game changer is that these platforms are online. Which means much lower operating costs than banks as they have no branch network. Besides the platforms usually develop their software with the most modern technologies while many banks are still running their systems on Cobol! It takes them ages and millions to change a simple thing…

And obviously, these savings can be passed to the customers of the P2P platforms. 😊

Transparency

Another major difference with the banks is the transparency.

When you put money on a deposit in a bank, you don’t know how they will use it. They may finance projects, companies or countries you don’t share the values.

This component received an echo especially among the millennials who are much more concerned with the green and social impact of their behavior and consumption.

With P2P lending, investors control the destination of their money. Of course, the borrowers they invest in remain anonymous but there is usually the possibility to filter among various criteria.

Besides, platforms usually share a lot of information and statistics. That’s not a hazard that we chose Klear as the name of our company. 😉

Fairness

Oh, that’s making a big difference!

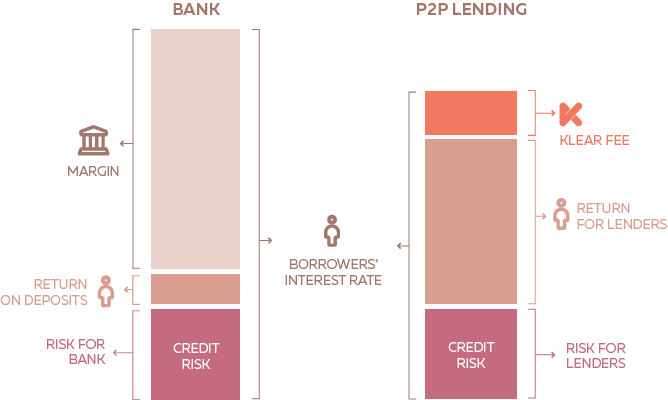

When a bank is selling a credit, the higher the interest rate, the higher will be the pocketed margin. This can lead to excessive pricing and proliferation of hidden fees…

On a platform, there is no such incentive to overcharge one side of the ecosystem at the expense of the other. By definition, a P2P lending platform is bound to find the fair balance between investors and borrowers.

This is a great intrinsic feature which helps a lot to provide fair conditions to all.

Facts & figures

All that was said above should be translated in concrete numbers.

Let’s look at we have delivered to its customers.

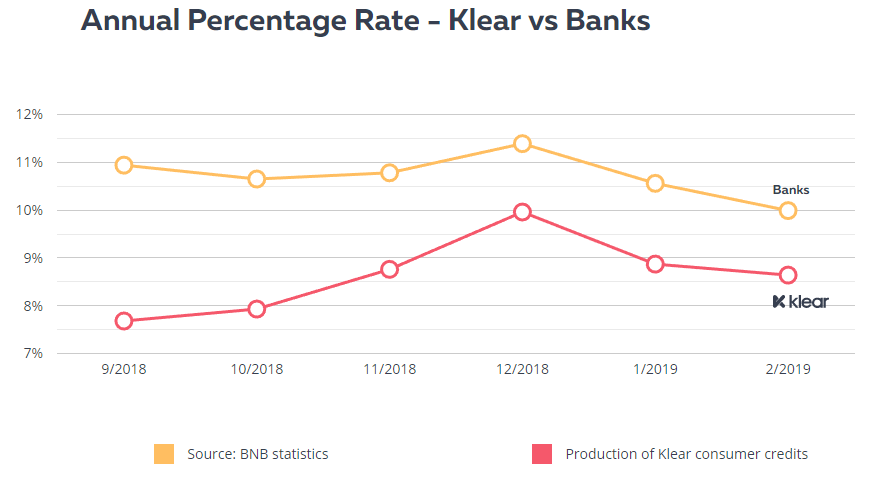

First, on the side of the borrowers, Klear has provided Personal Loans at rates on average cheaper than banks, by more than 15%.

This graph below uses official data published by the Bulgarian National Banks. Clear?

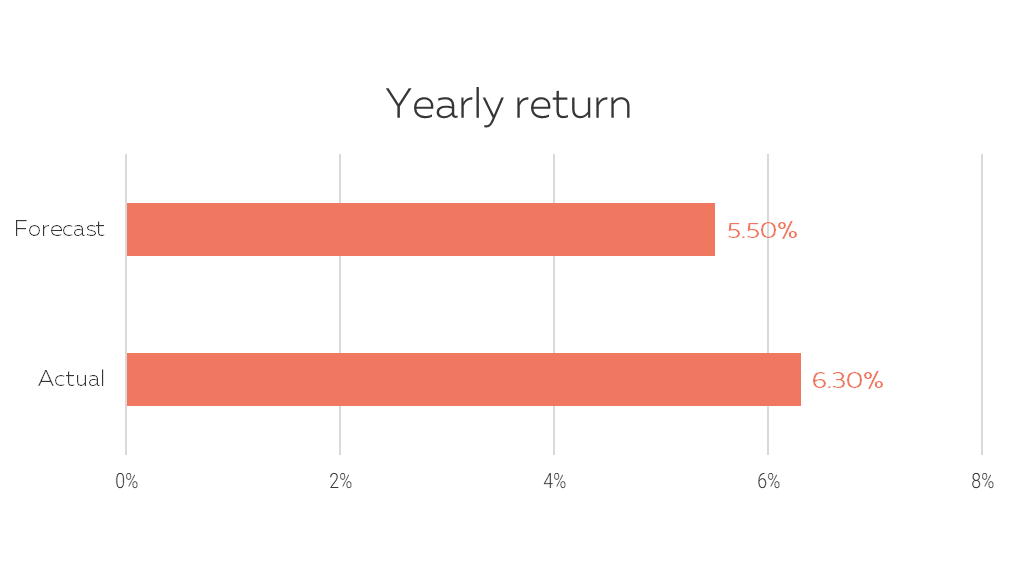

And on the other side, investors with Klear have achieved on average a net annual return of 6.3% while deposits are giving peanuts these days…  To make it short, everyone wins. 😊

To make it short, everyone wins. 😊

Results after 2 years of investing with Klear

Results after 2 years of investing with Klear

TOP 10 Everything about Peer to Peer Lending

TOP 10 Everything about Peer to Peer Lending

How is P2P lending taxed with Klear?

How is P2P lending taxed with Klear?

XIRR demystified with source code in C#

XIRR demystified with source code in C#