Last updated on

When we have exhausted all our options to collect a loan and the delay goes over 120 days, the whole loan is sold to an external debt collection agency, at a discount.

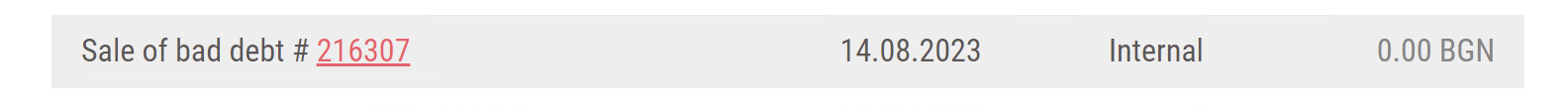

Every investor owning a piece of the sold bad loan will see in its Transactions tab the proceeds received from the sale of his piece.

![]()

At the same time, the piece of loan exits the portfolio, and the overall outstanding amount is decreased by the outstanding of the sold piece of loan.

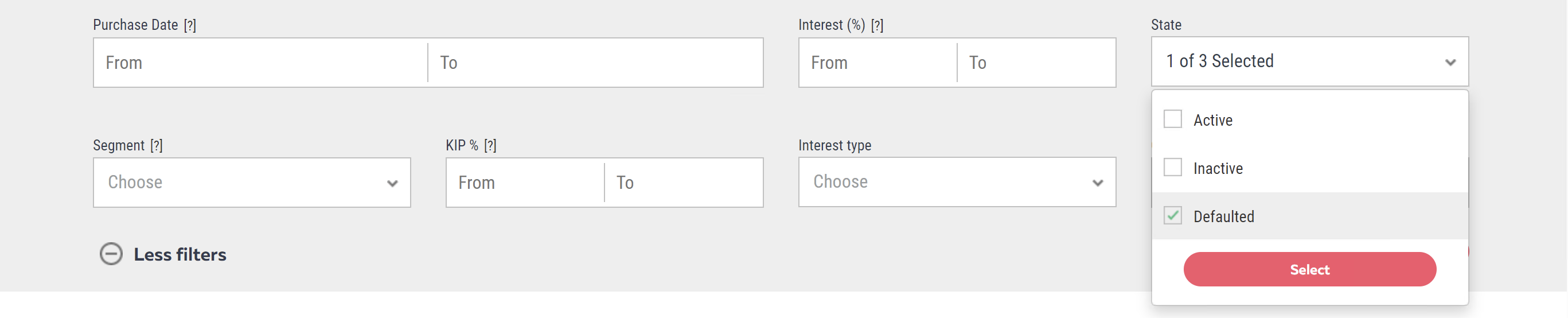

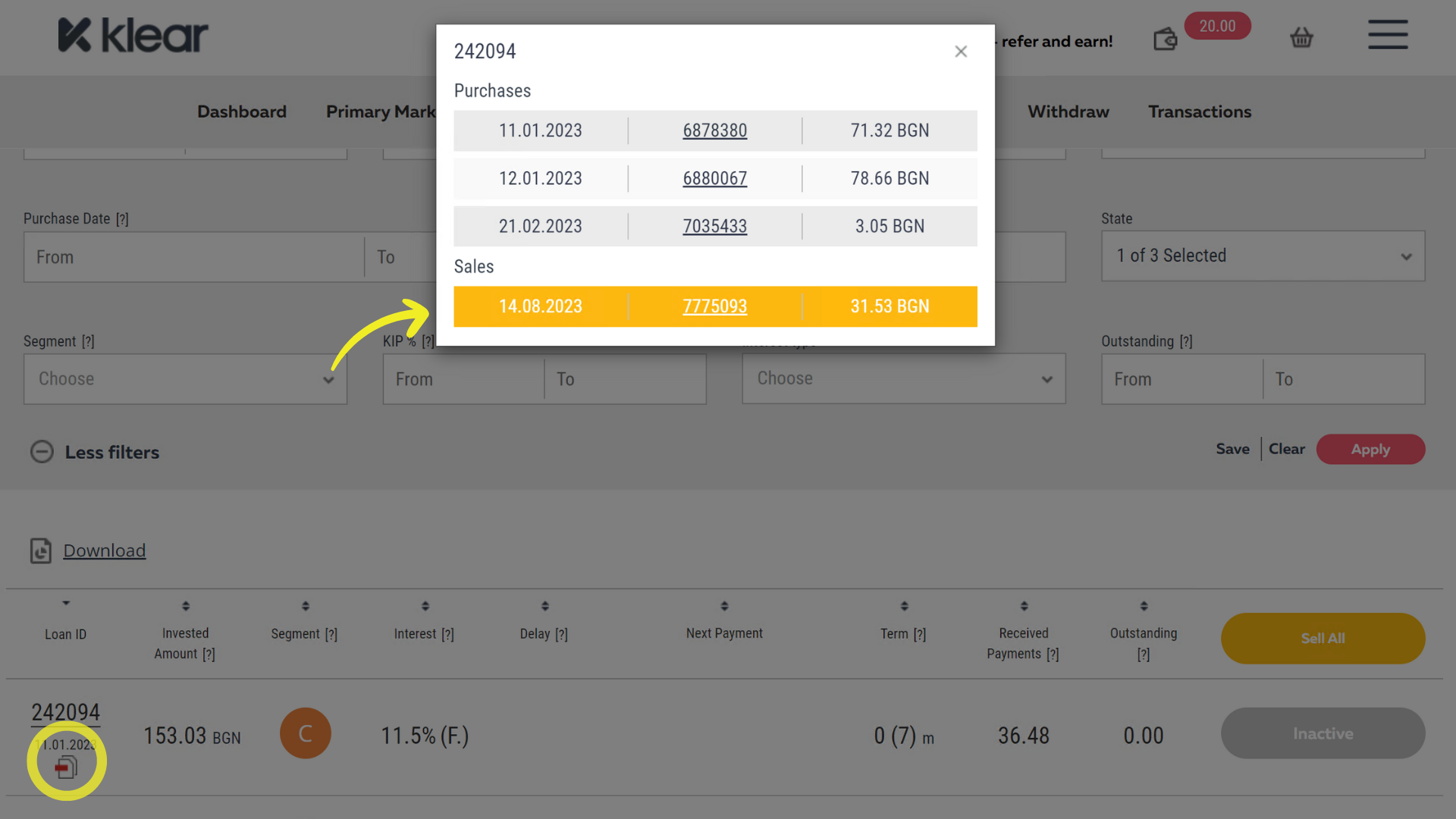

The details of the transaction can be seen in Portfolio, filtering the loans with status “defaulted” and opening the transaction history by clicking on the folder icon below the credit number.

1. Filtering defaulted loans

2. Opening the history of transactions on the defaulted loan

3. Opening the details of the last transaction

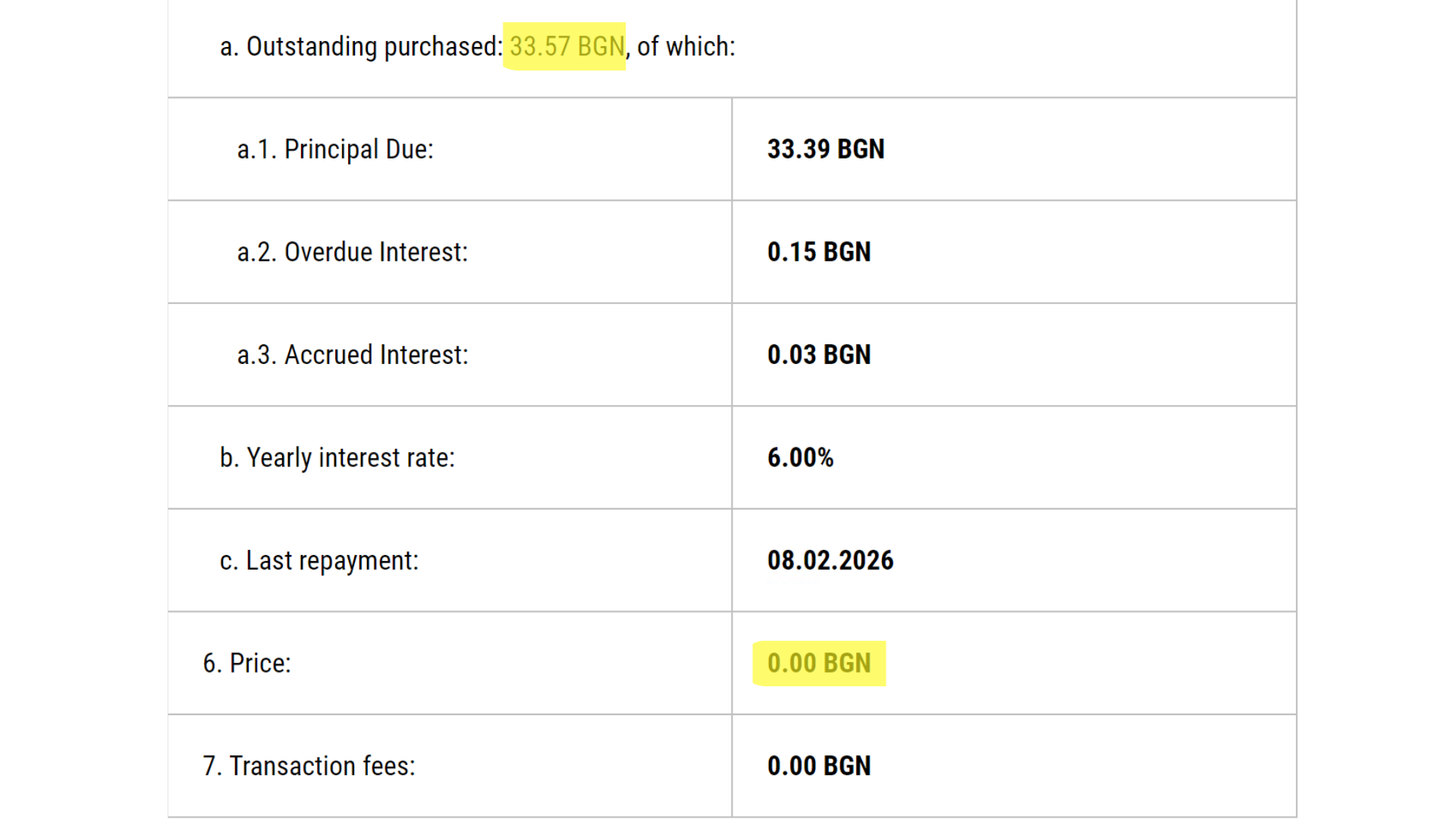

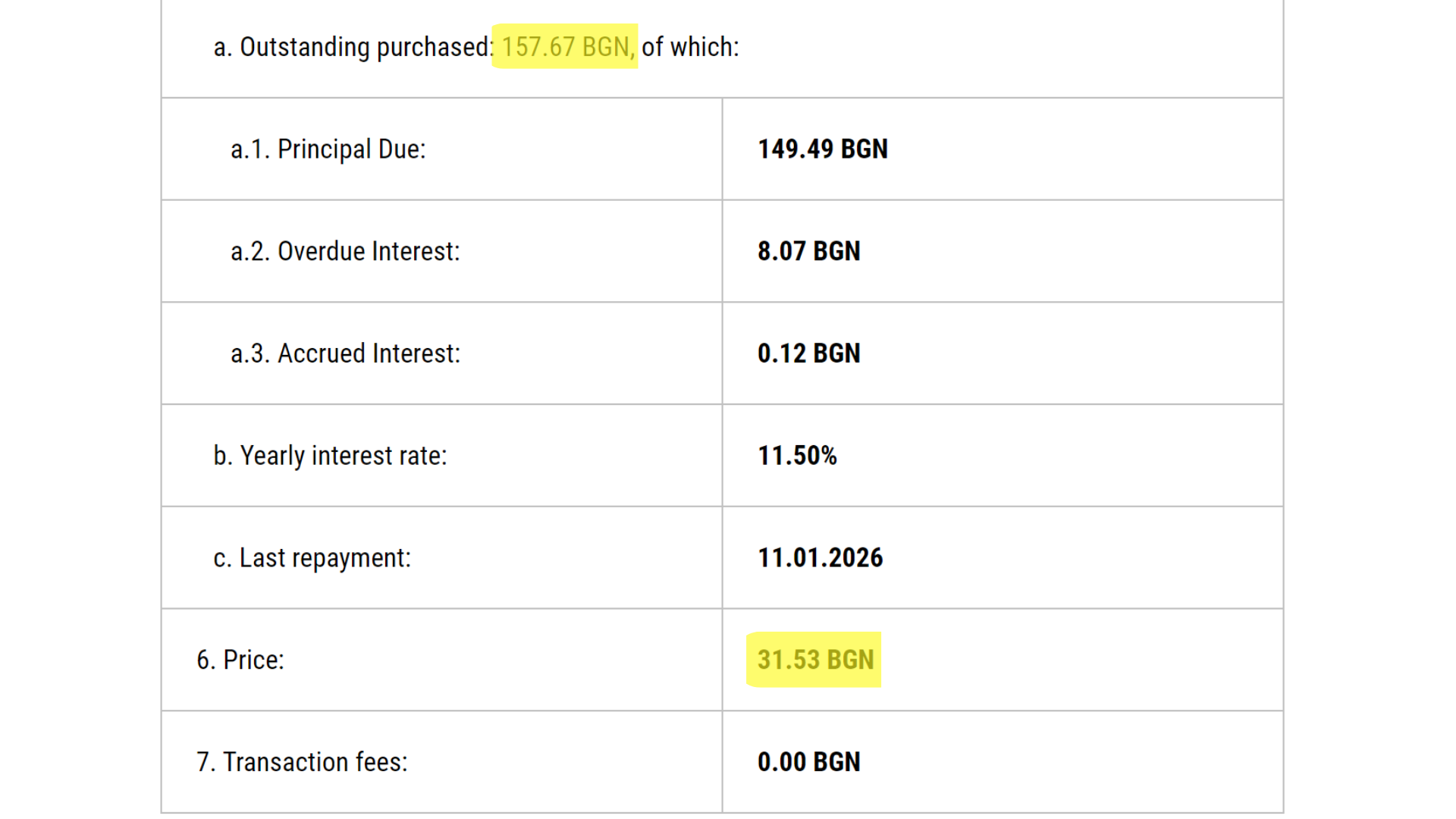

The annex of the sale gives all the details of the transaction:

A piece of 157.67 BGN was sold and taken out of the outstanding, while 31.53 BGN were credited on the wallet as the price paid by the agency for this piece. On this case, we can see that the price was 20% (31.53 / 157.67).

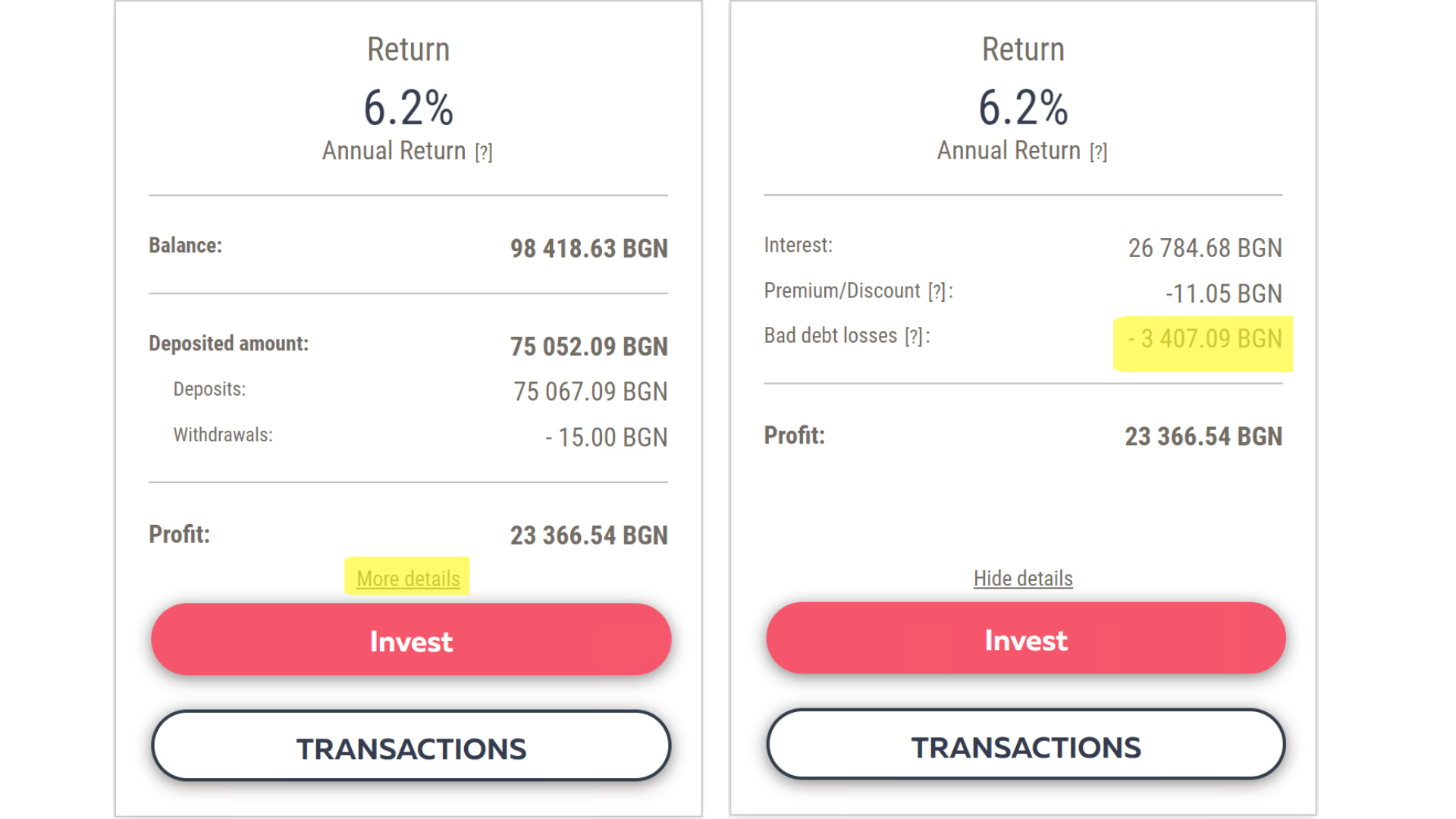

4. Checking the accumulated losses… and the profit

The loss, equal to the difference between the outstanding sold and the price received, is accumulated in the total loss displayed on the dashboard, in the detailed view of the central block about the return.

5. Conclusion

Selling a bad loan is part of the model as there is no lending business without risk.

Controlled lending is when the losses from the very few defaulted loans remain well below the interest received from the vast majority of sounds loans.

Every investor can check that on his dashboard in the details of the return.

6. A very specific and sad case

We had a recent unfortunate event, with a borrower who passed away.

As the ethical disruptor of Finance, Klear had decided from the very beginning of the platform to provide all loans with embedded feature protecting the borrower, and especially his family, in case of death or permanent disability. Please note that this cover is included in the interest rate. That’s why on the marketplace we can sometimes spot loans from the same segment and duration with a different rate. It is coming from the additional markup we put cover the specific risk.

In case of such a tragic event, we first check that the conditions to activate the cover are met.

Then, we proceed with a write-off of the loan, which is technically done by a repurchase at no value.

In this situation, the proceeds for the investors are equal to zero as the whole outstanding is written off.