Last updated on

Klear loan portfolio has reached 2 years maturity.

This is already a significant period of observation to assess its performance.

In a nutshell, the conclusion is positive as the return of the portfolio is higher than the forecast.

In the various graphs below, you’ll find more details about the returns and some statistics about our investors.

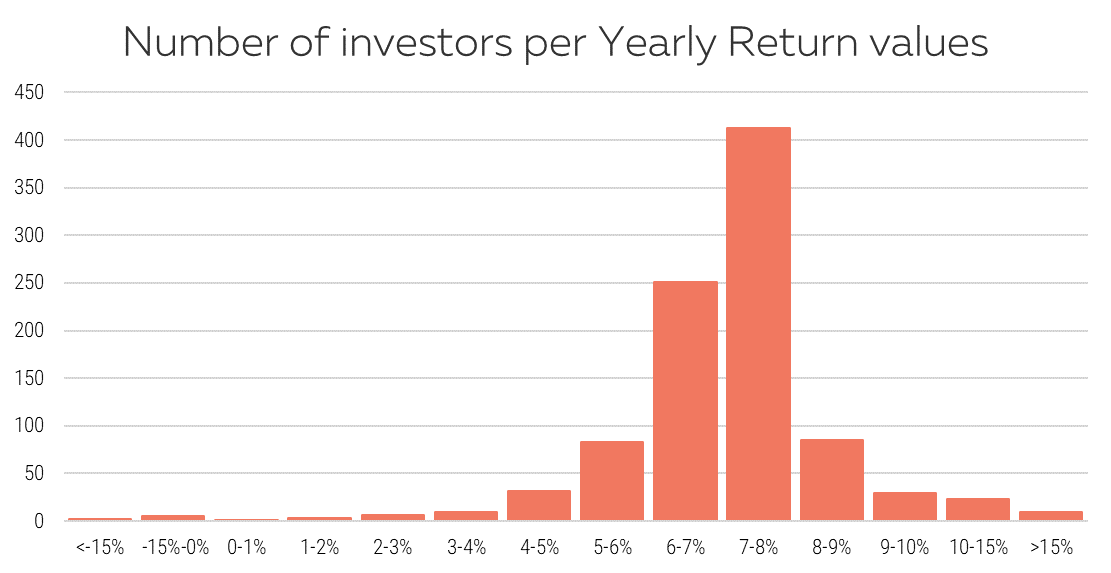

1. Average return of the whole portfolio

![]()

The annualized return of the whole portfolio since the launch is 6.3%, above the forecast.

This is good news. Now, 2 years have passed since the start of the activity and this result is a solid proof of the quality of the loans originated so far.

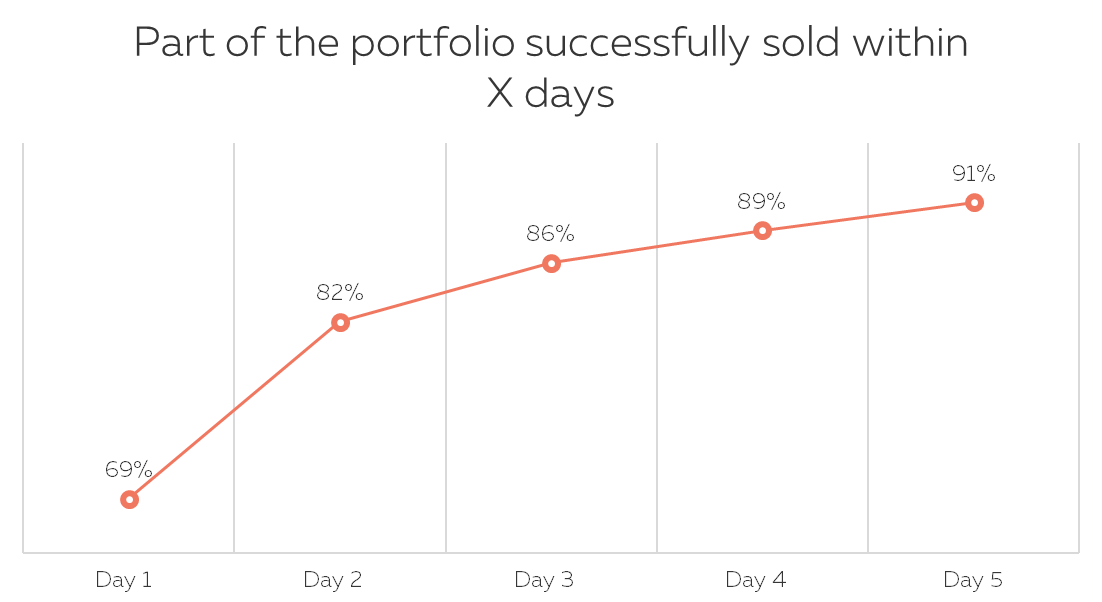

2. Net profit on the whole portfolio

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

The whole portfolio has generated a profit of almost 250 K BGN to all investors, including Klear.

This graph is another evidence that the P2P lending model works well. The loss from the few bad loans represents only a small fraction of the total amount of interest received from the well-performing loans.

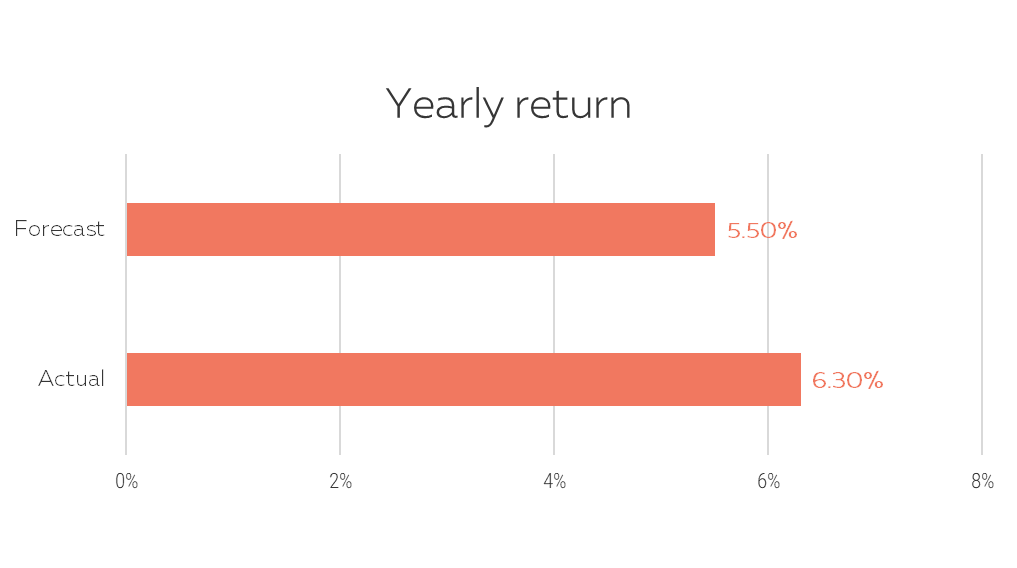

3. Investors by level of return

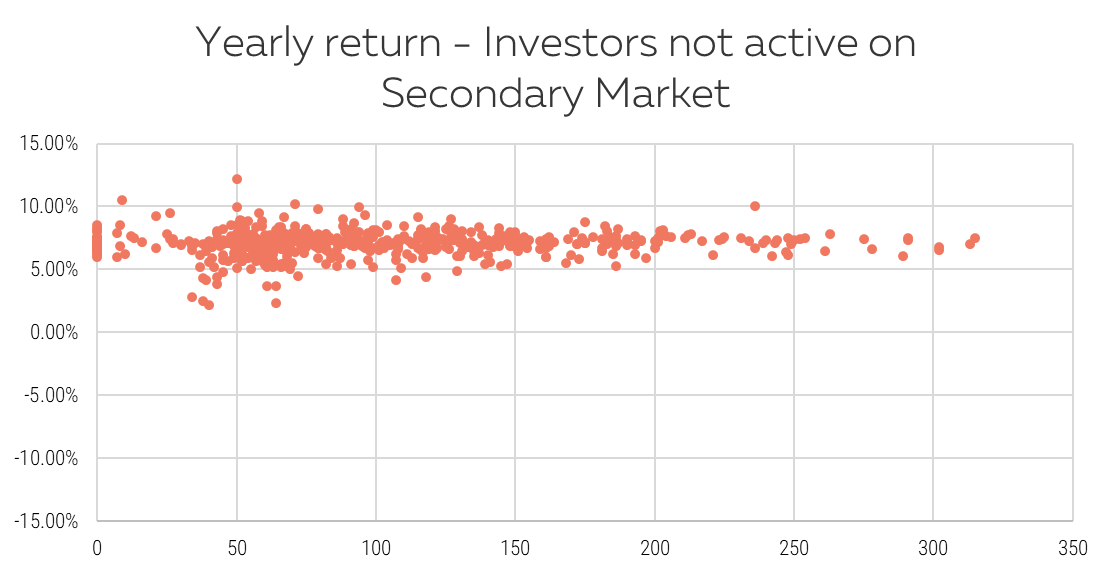

4. Return vs number of loans invested in (for investors not active on the secondary market)

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

It’s the perfect illustration of the diversification concept. The variability of the return decreases with the number of loans invested in.

For those who look for safety, investing in as many loans as possible and not playing on the secondary market is the way to go.

More info here about the precise rules to build this graph.

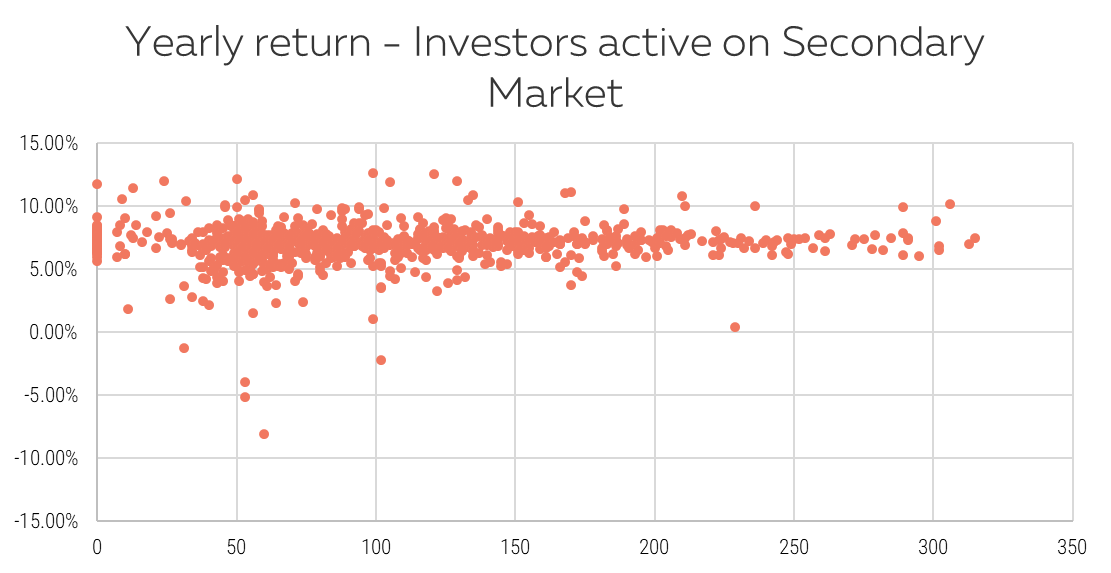

5. Return vs number of loans invested in (for investors active on the secondary market)

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

There is more variability on the returns of investors who are active on the secondary market. No surprise. Transacting on loans with problems is an opportunity to get a higher return but it also increases the risk to make a loss.

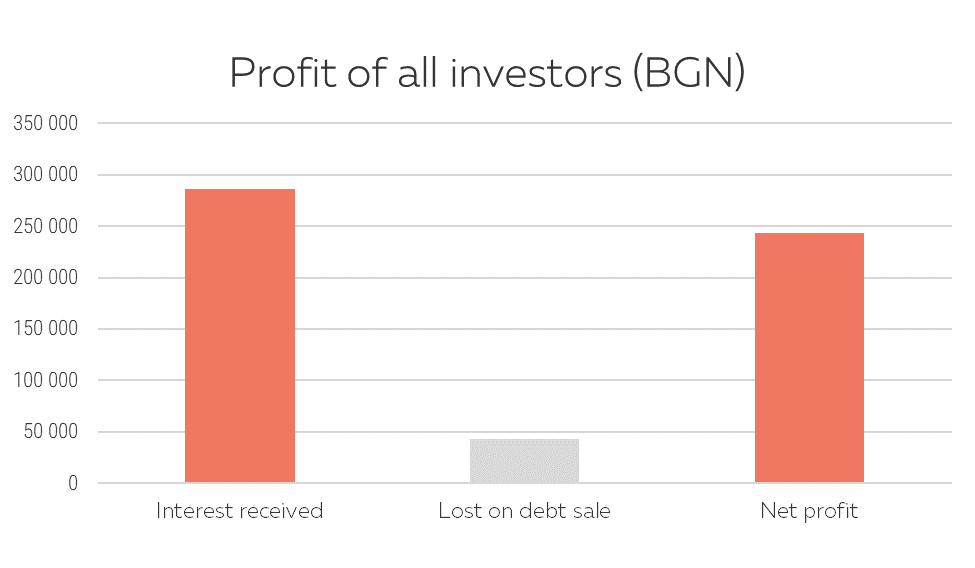

6. Time to sell

Within 5 days, most of the portfolio is sold. There is no significant change compared to the same statistics calculated approximatively 1 year ago.

P2P lending is not an instantly liquid asset. We remind you to always consider your horizon of investment before purchasing a loan.

However, it’s reassuring to see that in case you need to get back your money earlier than planned, the selling option offers a reasonable timeframe for such a situation.

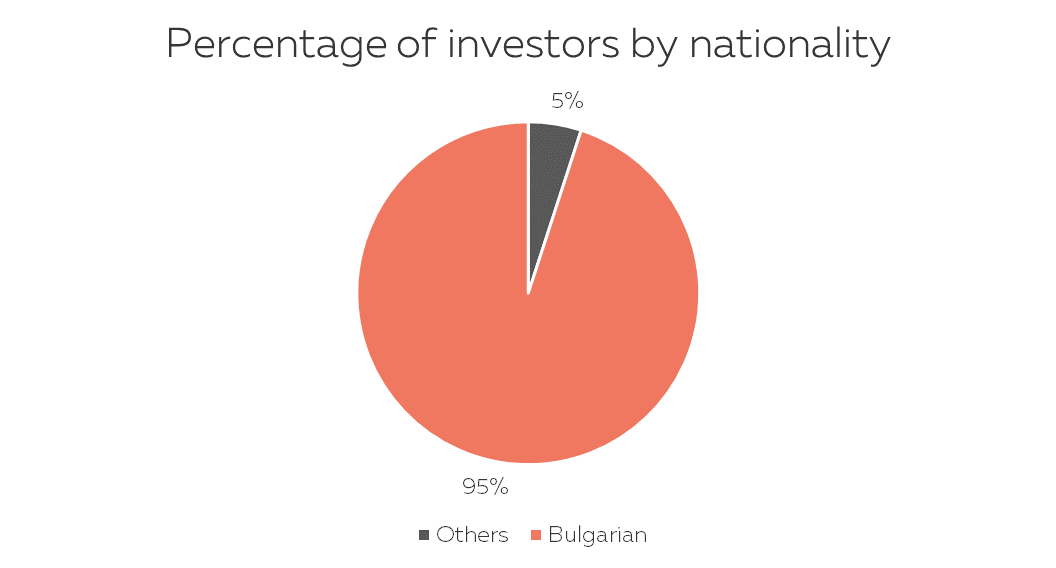

7. Investors by nationality

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

Most of our investors are Bulgarian citizens, including some living abroad.

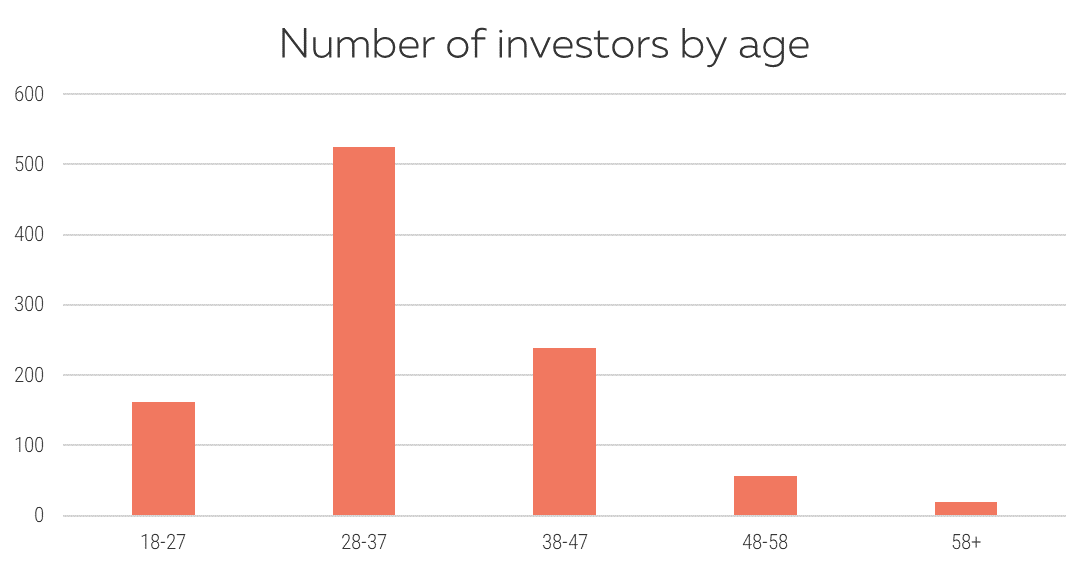

8. Investors by age

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

The median age is 33 years.

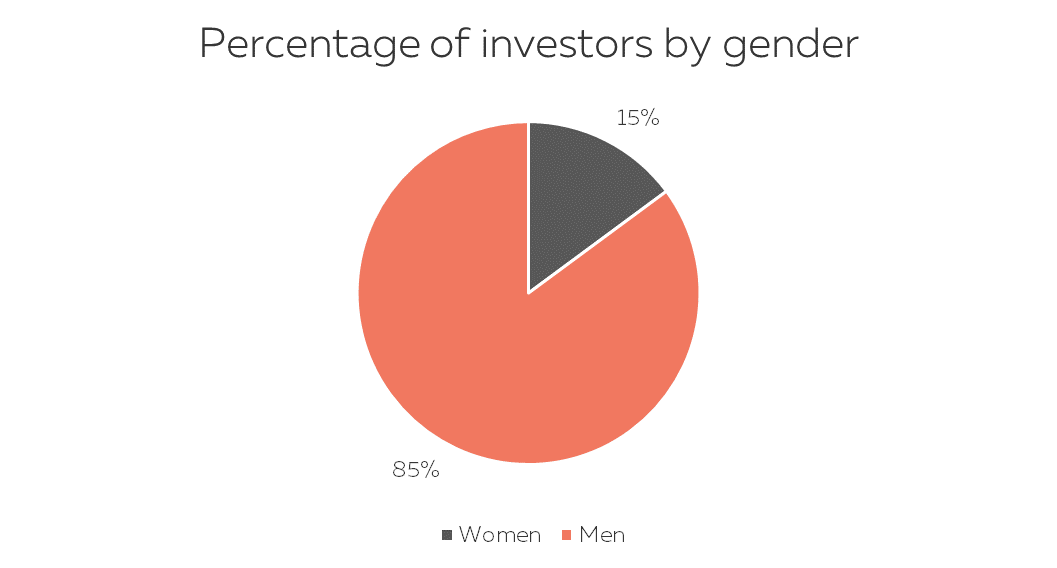

9. Investors by gender

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

During the recent months, we noticed a slight increase in the proportion of women investors. Let’s check if this shows up in the next report.

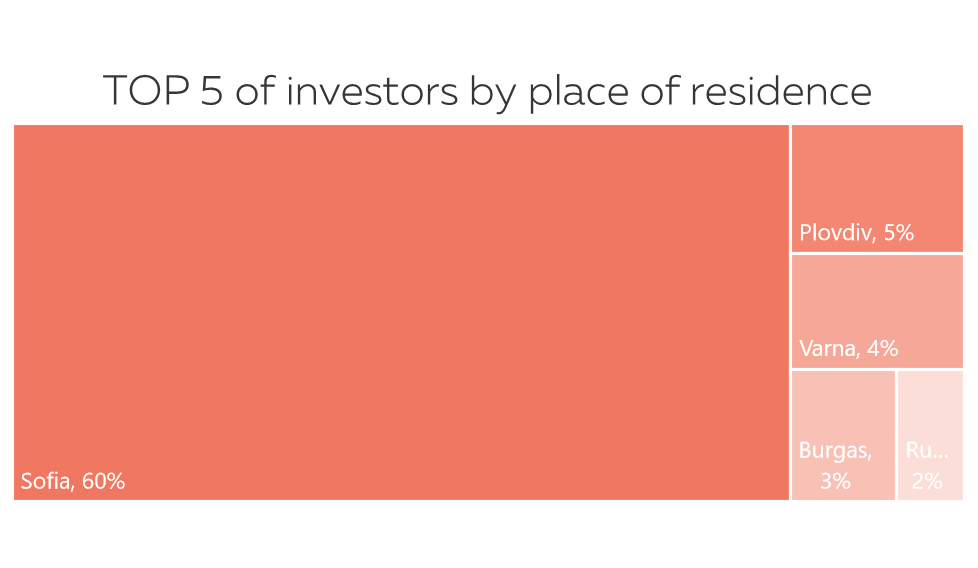

10. City of residence of investors from Bulgaria

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

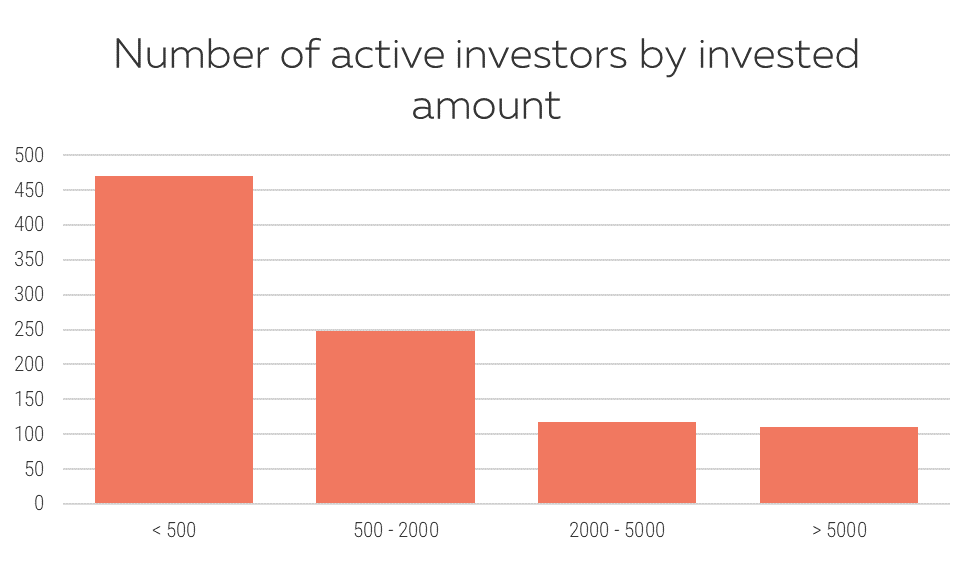

11. Investors by amount invested

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

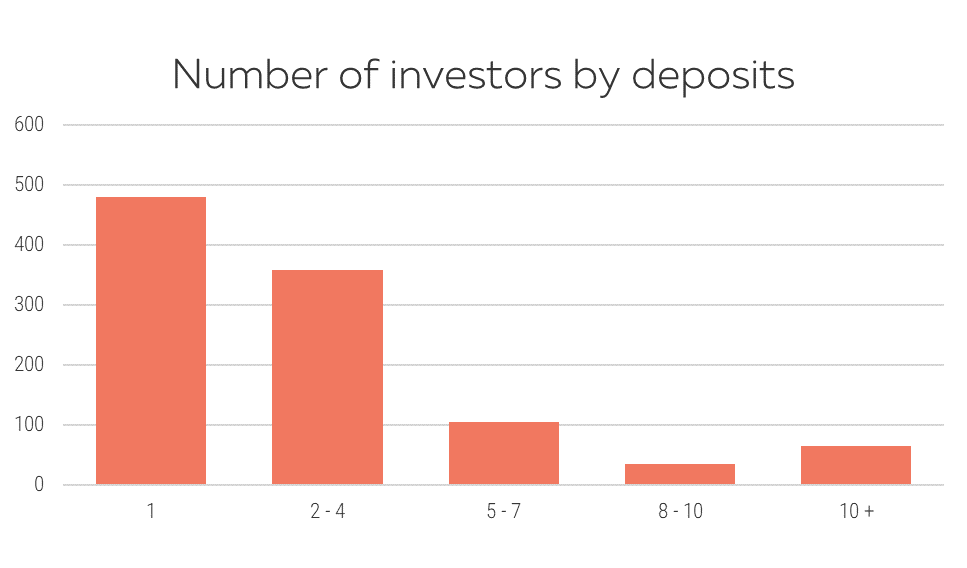

12. Investors by number of deposits

![https://www.klearlending.com/storage/public/blog/links/KPI-10-2018/EN/Graph%201%20EN.png]()

This shows the diversity of saving patterns.

There is a group of investors making a one-off investment. Probably, among them, we have a significant proportion of recently registered investors who wait to see how things go before increasing their investment. 😊

There is another group, investors having deposited money more than 5 times, who are regularly saving and investing part of their savings in P2P lending with Klear.

Results after 1 year of investing with Klear

Results after 1 year of investing with Klear

We performed our second debt sale

We performed our second debt sale